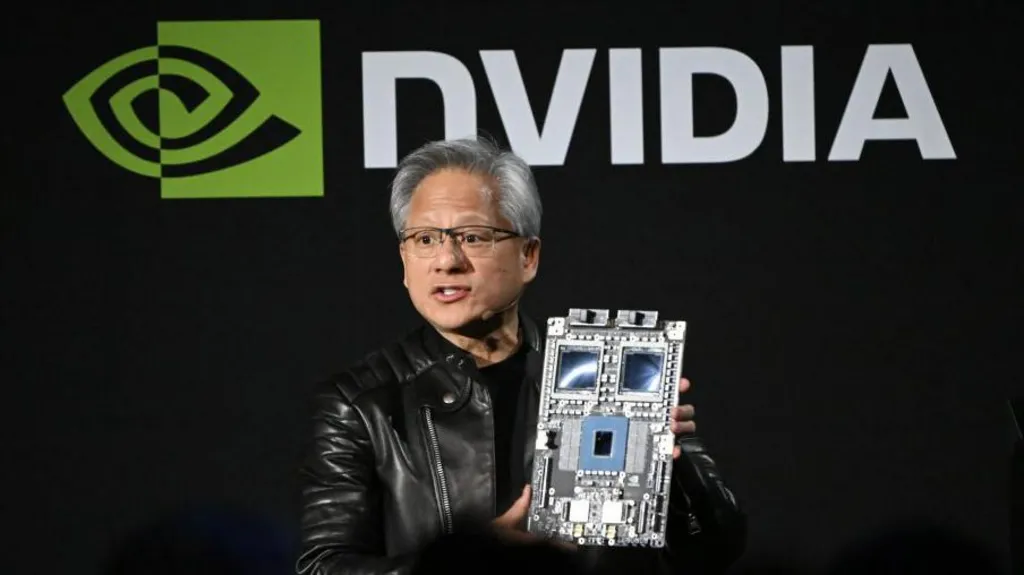

Tech stocks are wildly volatile, leaving investors reeling. Experts attribute this to uncertainty about long-term winners, reminiscent of the early auto industry where many companies failed. Unlike stable dividend-paying stocks, tech firms often reinvest for future growth, making their share prices sensitive to expectations. Any hint of slowing growth can trigger collapses. The “Magnificent Seven” (Nvidia, Alphabet, Amazon, Apple, Microsoft, Meta, Tesla) dominate, but face intense competition and rapid technological change. Tesla’s sales dip due to controversy and Chinese competition, while Nvidia’s share price dropped after a cheaper Chinese AI chatbot emerged. AI is the new battleground, fueling speculation. Any sign of lagging behind can cause investors to flee. Share prices often reflect investor optimism, which is fleeting and doesn’t guarantee success. Is this a replay of the dot-com boom, where hype overshadowed fundamentals?