Tech stocks are wildly volatile, reminiscent of the early car industry where many companies failed. Cambridge’s Prof. Dimson notes uncertainty about long-term winners fuels this. Unlike stable companies, tech firms often reinvest profits, making share prices sensitive to growth expectations. Hargreaves Lansdown’s Susannah Streeter says investors gamble on “jam tomorrow,” chasing future winners. News impacting growth prospects can trigger share value collapses.

Small expectation changes significantly affect share value across similar companies, echoing the dotcom boom. The dominance of the “Magnificent Seven” (Nvidia, Alphabet, Amazon, Apple, Microsoft, Meta, Tesla) makes the market vulnerable. Rapid technological change threatens established business models.

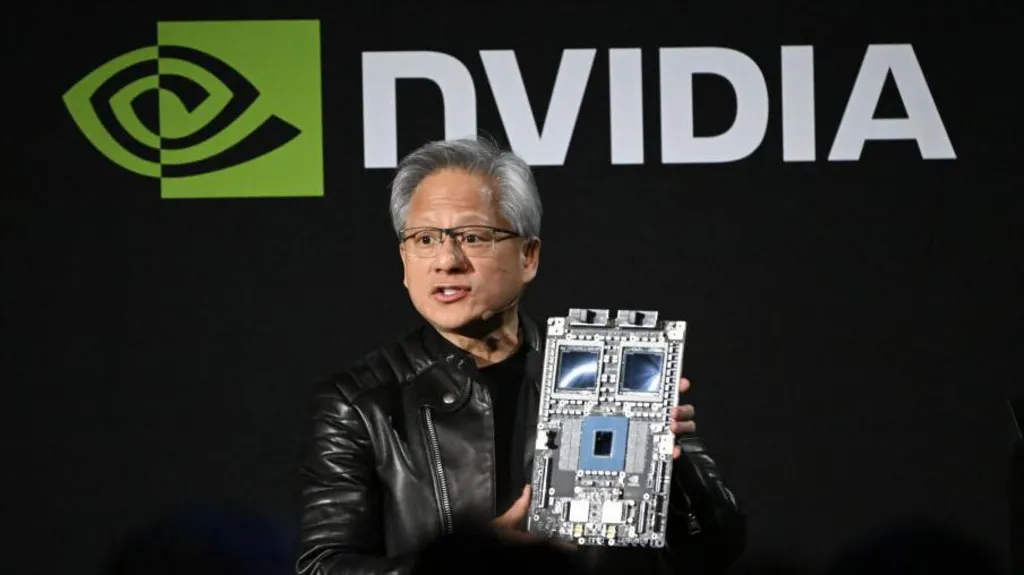

Tesla’s sales decline due to consumer opposition to Elon Musk and Chinese competition. Nvidia’s stock dipped after China’s DeepSeek AI app launch. AI’s pervasive influence makes shares sensitive to predictions. Vanderbilt’s Prof. Whaley states, “AI is certainly contributing to tech volatility. The race is on.” Investor optimism, not always rational, drives tech stock prices, leading to volatility as optimism fades or reality hits.